Table of Contents

- Executive Summary and Market Overview

- Key Applications and End-User Segments

- Technology Landscape: Advances in Backscatter Gamma-Ray Imaging

- Calibration Standards and Regulatory Frameworks

- Competitive Analysis: Leading Providers and Service Models

- Market Size, Growth Projections, and Regional Trends (2025–2030)

- Emerging Innovations in Calibration Techniques

- Challenges and Risk Factors in Service Delivery

- Customer Requirements and Procurement Strategies

- Future Outlook: Strategic Opportunities and Industry Roadmap

- Sources & References

Executive Summary and Market Overview

The backscatter gamma-ray imaging calibration services sector is gaining critical importance in 2025, driven by expanding applications across security screening, industrial inspection, and non-destructive testing. Calibration services ensure imaging systems provide accurate, reliable results—a necessity as global regulations tighten and performance expectations rise. The market is shaped by ongoing technological advancements, increased adoption in high-stakes environments, and a growing emphasis on traceable, standards-based calibration.

Currently, the sector is characterized by a mix of established metrology institutes and specialized industrial service providers. National laboratories such as the www.nist.gov in the United States and the www.npl.co.uk in the UK play pivotal roles in developing and disseminating calibration standards for gamma-ray and radiation imaging systems. These organizations are actively updating calibration protocols to meet the evolving needs of industrial and homeland security end users, particularly as imaging system resolution and sensitivity continue to improve.

In the commercial arena, companies like www.flir.com and www.mirion.com offer calibration services as part of broader portfolios for radiation detection and imaging solutions. Industrial service providers such as www.sgs.com and www.intertek.com are expanding their non-destructive testing service lines to include advanced gamma-ray imaging calibration, responding to demand in sectors like oil & gas, aerospace, and critical infrastructure.

2025 is seeing a notable increase in the implementation of automated and remote calibration techniques, reducing downtime and enhancing calibration consistency. There is also a trend toward integrating digital calibration certificates and blockchain-based traceability, as seen in recent pilot projects at major testing laboratories. This digital transformation is expected to accelerate as regulatory authorities, such as the www.iaea.org, emphasize data integrity and interoperability in inspection regimes.

Looking forward, the outlook for backscatter gamma-ray imaging calibration services is robust. The market is forecast to benefit from ongoing investments in nuclear security infrastructure, the expansion of automated industrial inspection, and the introduction of new gamma-ray imaging modalities. Providers that can deliver rapid, standards-compliant, and digitally integrated calibration services are well-positioned to capture emerging opportunities in both mature and developing markets.

Key Applications and End-User Segments

Backscatter gamma-ray imaging calibration services are becoming increasingly critical across several high-impact sectors as the demand for precise non-destructive inspection and imaging grows into 2025 and beyond. These calibration services ensure that backscatter gamma-ray imaging systems deliver accurate, repeatable results, crucial for both safety and quality assurance. The following outlines the key applications and end-user segments leveraging these services.

-

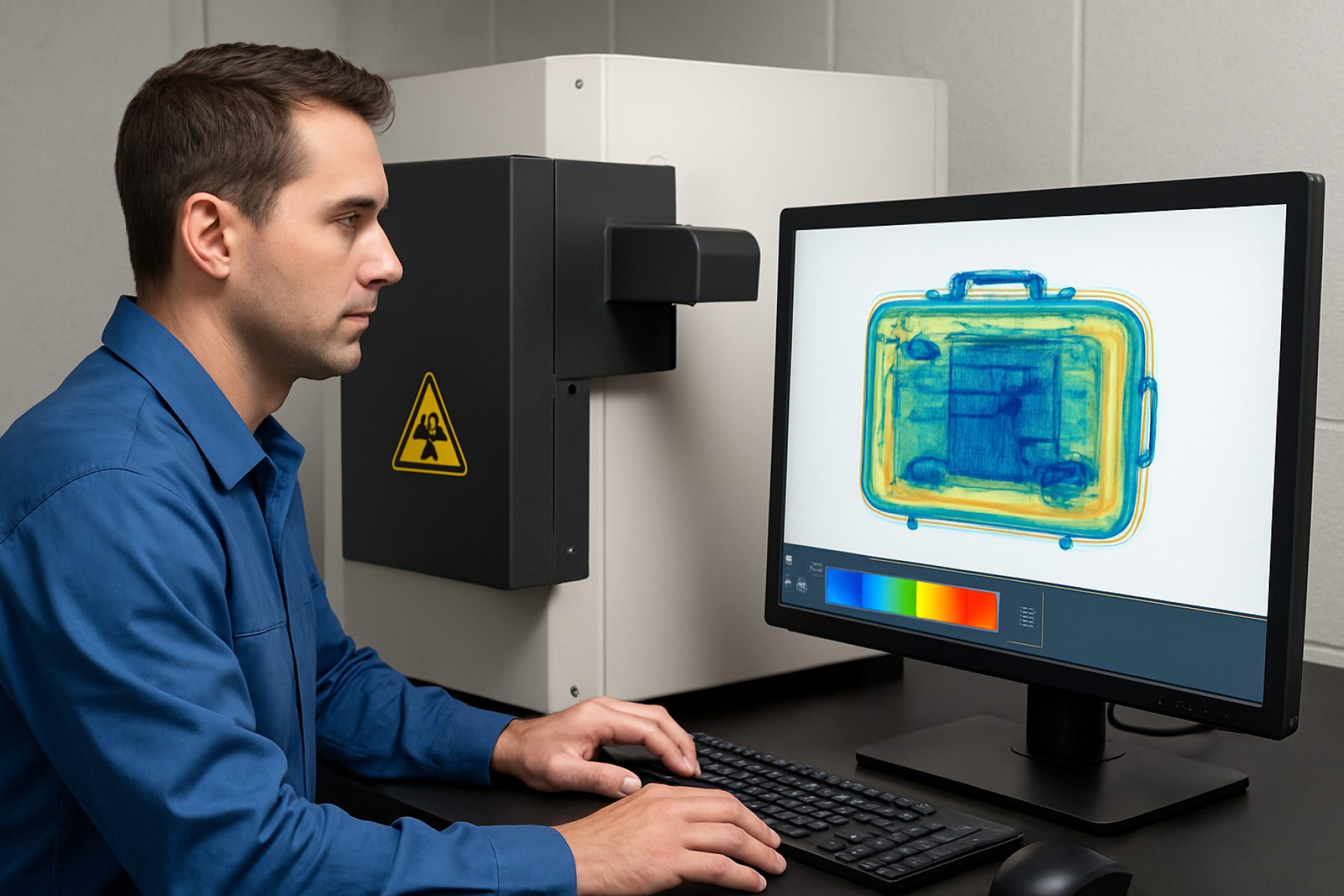

Homeland Security and Customs Inspection:

The need for rapid, non-invasive screening of cargo containers, vehicles, and luggage drives significant adoption of backscatter gamma-ray systems. Calibration services are essential to maintain detection sensitivity for contraband, explosives, and radioactive materials. Organizations such as www.rapiscansystems.com and www.leidos.com supply and calibrate these systems for border security agencies worldwide. -

Industrial Non-Destructive Testing (NDT):

Industries including oil & gas, aerospace, and manufacturing use backscatter gamma-ray imaging for weld inspection, corrosion analysis, and detection of structural flaws. Accurate calibration ensures compliance with safety and quality standards, reducing the risk of undetected defects. Companies such as www.ge.com and www.olympus-ims.com offer equipment and calibration services for these applications. -

Medical and Healthcare Imaging:

While traditional gamma-ray imaging plays a larger role in medical diagnostics, backscatter techniques are emerging in specialized applications such as bone density measurement and detection of foreign objects. Calibration services are vital for patient safety and diagnostic accuracy. Providers like www.siemens-healthineers.com ensure regular calibration and maintenance for clinical imaging devices. -

Research and Academic Institutions:

Universities and national laboratories rely on calibrated backscatter gamma-ray systems for material science, nuclear physics, and security research. Routine calibration by certified providers is critical for experimental repeatability and regulatory compliance. Organizations such as www.nist.gov support calibration standards and reference materials for this community.

Looking ahead to 2025 and beyond, the expansion of automated inspection, growing regulatory scrutiny, and advances in detector technology are expected to drive greater demand for backscatter gamma-ray imaging calibration services, particularly in high-security and high-reliability sectors. As imaging applications diversify, the role of specialized calibration providers will become even more pivotal across these key end-user segments.

Technology Landscape: Advances in Backscatter Gamma-Ray Imaging

Backscatter gamma-ray imaging (BGRI) systems have become increasingly vital across sectors such as security screening, non-destructive testing (NDT), and nuclear facility monitoring. As adoption accelerates in 2025 and beyond, the demand for precise calibration services—ensuring measurement accuracy, regulatory compliance, and interoperability with evolving technologies—has intensified.

Calibration for BGRI systems involves the adjustment and verification of system response to standardized gamma-ray sources and reference materials. Leading manufacturers and national laboratories have responded with advances in both hardware calibration tools and digital calibration processes. For example, www.thermofisher.com and www.mirion.com both offer calibration solutions for gamma-ray detectors, including portable and fixed configurations. These solutions include traceable calibration sources, software correction algorithms, and automated calibration routines to minimize human error and downtime.

An important trend in 2025 is the integration of digital twins and AI-assisted calibration protocols. Companies such as www.ansys.com are developing simulation environments that enable virtual calibration, reducing the need for frequent live source calibrations and allowing for predictive maintenance. In parallel, organizations like the www.nist.gov continue to update and expand their gamma-ray calibration services, supporting both commercial and governmental clients with traceable reference measurements and uncertainty analysis.

Another ongoing advancement involves the standardization of calibration protocols. Industry groups and standards bodies, such as the www.iaea.org, are working to harmonize calibration procedures internationally, recognizing the increasing cross-border use of BGRI systems in trade and security. This standardization is particularly relevant as new detector materials, such as cadmium zinc telluride (CZT) and high-purity germanium (HPGe), become more prevalent, introducing unique calibration requirements and opportunities for further accuracy gains.

Looking ahead to the next few years, the calibration services market is expected to benefit from more automated, remote, and cloud-connected solutions. Remote calibration and monitoring platforms, as pioneered by companies like www.flir.com, are enabling real-time performance tracking and instant recalibration, reducing downtime and travel costs. As BGRI systems proliferate in critical infrastructure and transportation, continuous improvement and investment in calibration services will remain essential for both performance and compliance.

Calibration Standards and Regulatory Frameworks

As backscatter gamma-ray imaging (BGRI) technologies become increasingly integral to sectors such as security screening, non-destructive testing, and nuclear safeguards, the demand for robust calibration services has escalated. Calibration standards and regulatory frameworks are critical in ensuring the accuracy, repeatability, and safety of these systems. In 2025 and the coming years, several key developments and initiatives are shaping the calibration landscape for BGRI.

Globally, the calibration of gamma-ray systems—including backscatter modalities—relies on traceability to national measurement standards. Organizations such as the www.nist.gov in the United States and the www.npl.co.uk in the United Kingdom provide primary calibration services and reference sources. These institutions maintain calibration facilities for gamma-ray detectors, ensuring that commercial and research users can reference their systems to internationally recognized standards.

Recent years have seen a tightening of regulatory requirements, particularly in security and nuclear applications. Agencies like the www.iaea.org have updated guidelines to improve the reliability and traceability of radiological measurement systems, including those employing backscatter techniques. These frameworks increasingly require documented calibration with certified reference sources, regular performance verifications, and detailed calibration records.

On the supply side, leading manufacturers such as www.mirion.com and www.thermofisher.com offer specialized calibration services for gamma-ray imaging devices. Their calibration protocols are frequently updated to align with new standards and regulatory mandates, incorporating advances in detector technologies, improved reference sources, and digital record-keeping. These companies increasingly provide on-site calibration services and remote verification, leveraging digital platforms for compliance documentation.

- In 2025, the emergence of automated calibration solutions and digital twins is anticipated to streamline compliance, reduce downtime, and improve calibration accuracy for BGRI systems.

- National and international standards bodies are collaborating on harmonizing calibration protocols to facilitate cross-border use of BGRI equipment, particularly for customs and homeland security applications.

- Ongoing research aims to develop new reference materials and low-uncertainty calibration sources, with pilot programs underway in partnership with www.nist.gov and www.npl.co.uk.

The outlook for the next few years points to increasingly stringent calibration requirements, greater automation, and a stronger emphasis on traceability and cross-border interoperability, driven by both regulatory evolution and rapid technological advances in BGRI systems.

Competitive Analysis: Leading Providers and Service Models

The market for backscatter gamma-ray imaging calibration services is experiencing steady evolution in 2025, driven by advancements in imaging technologies and heightened regulatory requirements in sectors such as security, nuclear, and industrial inspection. Competitive dynamics are shaped by a small group of specialized service providers and original equipment manufacturers (OEMs), each offering distinct calibration models and technical capabilities.

Among the leading providers, www.nist.gov continues to play a critical role by establishing reference standards and offering calibration services for gamma-ray detection and imaging systems. NIST’s calibration laboratories support commercial and government users, ensuring traceability and compliance with international measurement standards. The institute’s ongoing research into calibration protocols—such as those for high-resolution imaging detectors and portable backscatter systems—has set benchmarks for the industry.

On the commercial front, www.mirion.com and www.thermofisher.com have maintained their positions as global leaders. Both companies provide calibration services not only for their own backscatter gamma-ray imaging products but also for third-party systems. Their service models typically include on-site calibration, remote assistance, and periodic maintenance contracts to ensure continuous system accuracy. For instance, Mirion leverages its global service network to offer rapid turnaround and compliance documentation, targeting critical infrastructure and border security sites.

In Europe, www.tuv.com has expanded its metrology and calibration services, focusing on ensuring compliance with European radiological safety standards. TÜV’s service model emphasizes independent validation for clients operating in regulated environments, such as nuclear power plants and customs agencies.

Service models are increasingly shifting toward integrated digital platforms. Providers like www.fluxionbiosciences.com are piloting remote calibration diagnostics, leveraging cloud-based data analytics to monitor detector performance and predict recalibration needs. This transition reflects broader industry trends toward predictive maintenance and lifecycle management, aiming to reduce downtime and operational costs.

Looking ahead, competitive differentiation is likely to hinge on the ability to offer traceable, automated, and remote calibration solutions. Providers investing in AI-driven diagnostics, secure data exchange, and compliance with evolving international standards—such as those being updated by the International Electrotechnical Commission—are poised to capture market share. Collaboration between OEMs and standards bodies will be crucial, as end-users in high-security and regulatory environments demand ever-greater assurance and documentation of calibration accuracy.

Market Size, Growth Projections, and Regional Trends (2025–2030)

The backscatter gamma-ray imaging calibration services sector is poised for moderate but steady growth from 2025 through 2030. As industries such as nuclear power, oil & gas, aerospace, and homeland security increasingly depend on non-destructive testing (NDT) and advanced inspection solutions, the demand for precise calibration services is expected to rise. These services are critical for ensuring measurement accuracy, compliance with safety standards, and the reliability of gamma-ray imaging systems.

Globally, North America and Europe remain the largest markets for calibration services, driven by robust regulatory environments and the high penetration of gamma-ray imaging technologies in industrial and security applications. The United States, in particular, benefits from a mature infrastructure and established players such as www.nist.gov, which offers calibration services and maintains radiation standards essential for the sector.

In Europe, organizations like the UK’s www.npl.co.uk and Germany’s www.ptb.de provide reference standards and calibration services that underpin much of the region’s industrial gamma-ray imaging activities. These institutes are continually developing new calibration methods to support innovations in detector technology and imaging resolution.

The Asia-Pacific region is forecast to see the fastest growth, fueled by expanding industrial bases in China, India, and Southeast Asia. Increasing investments in nuclear energy, infrastructure development, and heightened security concerns are propelling the adoption of backscatter gamma-ray imaging systems—and, consequently, calibration service demand. Leading suppliers such as www.csnc.com.cn are expanding their calibration and support capabilities to meet regional needs.

From a market size perspective, industry data and public disclosures from organizations like www.flir.com and www.mirion.com—both active in gamma-ray imaging and calibration—suggest a multi-million dollar global market, with annual growth rates in the range of 5–7% projected through 2030. This is due in part to stricter regulatory requirements and the increasing sophistication of imaging systems, which require more frequent and precise calibration.

Looking ahead, the sector is expected to see greater adoption of automated calibration procedures, digital record-keeping, and remote calibration support, all of which will further stimulate market growth and regional expansion. Initiatives from industry bodies such as the www.oecd-nea.org to harmonize calibration standards across borders may also facilitate market participation and service innovation in the coming years.

Emerging Innovations in Calibration Techniques

Backscatter gamma-ray imaging (BGRI) has become an indispensable tool in non-destructive testing, homeland security, and industrial inspection. As precision and reliability demands grow, calibration services for BGRI systems are experiencing significant innovation. The year 2025 and the near future are marked by a surge in advanced calibration techniques, digital integration, and the adoption of automation to ensure traceable and standardized system performance.

A major trend shaping the sector is the transition towards digital calibration platforms that streamline the process and enhance reproducibility. Leading metrology organizations, such as the www.nist.gov, are expanding their gamma-ray calibration facilities, integrating automated source handling and real-time data analysis. This enables more efficient calibration schedules and reduces human error. By leveraging remote monitoring and cloud-based data archiving, service providers are offering clients instant access to calibration certificates and historical performance records.

In 2025, calibration services are also adopting advanced reference materials and phantoms that better simulate real-world inspection targets. Companies like www.canberra.com have introduced new calibration phantoms tailored to specific BGRI applications, such as cargo inspection or pipeline analysis. These phantoms are engineered for durability and precise attenuation characteristics, enabling more representative system response verification and reducing recalibration intervals.

Another innovation is the use of machine learning for calibration optimization. System manufacturers, including www.rapiscan.com, are deploying AI-driven algorithms within their imaging platforms to monitor calibration drift, detect anomalies, and recommend proactive recalibration. This predictive maintenance approach minimizes unscheduled downtime and extends equipment lifespans.

International standardization efforts are also advancing. Bodies such as the www.iaea.org are collaborating with industry stakeholders to develop updated best practice guidelines for BGRI calibration, ensuring global consistency in radiological safety and measurement accuracy. These standards are expected to influence regulatory requirements and procurement specifications in the coming years.

Looking ahead, the convergence of digital tools, advanced materials, and AI-driven processes is set to further elevate the reliability, efficiency, and traceability of BGRI calibration services. Clients across security, infrastructure, and manufacturing sectors can anticipate more automated, standardized, and user-friendly calibration solutions as the industry embraces these emerging innovations.

Challenges and Risk Factors in Service Delivery

Backscatter gamma-ray imaging calibration services are essential for ensuring the accuracy and reliability of non-destructive testing (NDT) equipment across industries such as nuclear, security, and manufacturing. However, the delivery of these calibration services in 2025 and the coming years faces a complex array of challenges and risk factors that stakeholders must navigate.

-

Regulatory Compliance and Evolving Standards:

Regulatory bodies such as the International Atomic Energy Agency (www.iaea.org) and national authorities routinely update standards for radiation safety, instrument performance, and calibration traceability. Keeping calibration protocols aligned with these evolving standards demands ongoing investment in staff training, documentation, and quality assurance. Non-compliance risks service interruptions or legal repercussions. -

Access to Certified Reference Materials and Sources:

Reliable calibration requires high-quality reference sources and phantoms traceable to national or international standards, such as those maintained by the National Institute of Standards and Technology (www.nist.gov). Fluctuations in global supply chains, logistical restrictions, or regulatory hurdles surrounding radioactive sources can hinder timely access, especially for specialized isotopes used in advanced backscatter systems. -

Technical Complexity and Equipment Diversity:

Backscatter gamma-ray imaging systems are increasingly sophisticated, incorporating advanced detectors, electronics, and software. Calibration service providers must stay abreast of the rapid technological evolution led by manufacturers like www.thermofisher.com and www.mirion.com. Ensuring compatibility and accuracy across diverse platforms adds to operational complexity and risk. -

Personnel Safety and Security Concerns:

The handling and transport of gamma-ray sources for calibration pose inherent safety risks. Providers must rigorously implement and update radiation protection protocols in line with local and international guidelines (www.oecd-nea.org). Additionally, heightened global concerns over the security of radioactive materials demand enhanced monitoring, regulatory clearance, and sometimes escort requirements, increasing logistical burdens. -

Market and Economic Pressures:

Global economic uncertainties in 2025, such as fluctuating energy costs and supply constraints, can impact calibration service pricing and availability. Budgetary pressures may lead some end-users to delay or reduce calibration frequency, increasing the risk of undetected equipment drift or failure.

Despite these challenges, leading calibration laboratories are investing in automation, remote diagnostics, and digital record-keeping to mitigate risks and enhance service resilience. Collaboration with equipment manufacturers and regulatory agencies will be key to ensuring robust, future-proof calibration services for backscatter gamma-ray imaging systems in the coming years.

Customer Requirements and Procurement Strategies

In 2025, customer requirements and procurement strategies for backscatter gamma-ray imaging calibration services are driven by increasing demands for accuracy, regulatory compliance, and operational efficiency. Key sectors utilizing these services include nuclear power generation, security screening, industrial non-destructive testing, and advanced research laboratories. End-users—ranging from utility operators and border security agencies to aerospace manufacturers—require calibration solutions that ensure the reliability and safety of gamma-ray imaging equipment.

A critical customer requirement is adherence to national and international calibration standards, such as those set by the International Organization for Standardization (ISO) and the International Electrotechnical Commission (IEC). For example, the www.nist.gov provides traceable calibration services to support regulatory and quality assurance needs in the United States. European customers often look to www.ptb.de for similar services, ensuring compliance with EU directives and harmonized standards.

Procurement strategies in 2025 reflect a shift toward long-term service agreements and digital integration. Many customers now prefer multi-year calibration contracts with providers that offer on-site as well as laboratory-based calibration, minimizing equipment downtime. For example, companies such as www.ametekcalibration.com and www.flukecal.com have expanded their service portfolios to include remote calibration support and automated documentation, aligning with customer requirements for rapid turnaround and minimal operational disruption.

Another emerging trend is the incorporation of digital calibration certificates and integration with asset management software. Customers increasingly require calibration data to be delivered in standardized digital formats for seamless integration into quality management and compliance workflows. This is facilitated by platforms like Fluke’s MET/CAL software suite, which streamlines record keeping and audit readiness (www.flukecal.com).

- Customer expectations for turnaround times are tightening, with service-level agreements (SLAs) commonly stipulating calibration within a few business days.

- There is a rising demand for calibration providers that can support a diverse range of gamma-ray imaging systems, including portable and fixed installations.

- Procurement departments increasingly evaluate providers on their ability to demonstrate measurement traceability, regulatory compliance, and cybersecurity protocols for digital records.

Looking ahead, procurement strategies are expected to further emphasize supplier partnerships that support predictive maintenance and remote diagnostics, enabled by IoT-connected gamma-ray imaging equipment. Customers will continue to prioritize providers who can deliver robust, auditable calibration solutions that keep pace with evolving regulatory and technological landscapes.

Future Outlook: Strategic Opportunities and Industry Roadmap

The future outlook for backscatter gamma-ray imaging calibration services is shaped by evolving industry standards, technological advancements, and increasing regulatory requirements. As the demand for precise, reliable, and safe non-destructive testing (NDT) grows—particularly in critical sectors such as oil and gas, aerospace, and homeland security—service providers are expected to broaden their calibration capabilities and certifications to meet stringent client and governmental expectations.

By 2025, several trends are poised to influence the strategic direction of the industry. First, the adoption of advanced digital calibration techniques and automated systems is gaining momentum. Companies such as www.mirion.com are expanding their calibration services to include digital recordkeeping, automated quality assurance, and remote calibration support, enabling faster turnaround and reducing operational downtime. Similarly, www.ortech.ca is investing in cloud-based calibration data management, facilitating greater traceability and compliance with international standards.

Second, regulatory bodies—including the International Atomic Energy Agency (IAEA) and national radiation safety authorities—are moving toward tighter oversight and enforcement. This compels calibration service providers to pursue broader accreditation, such as ISO/IEC 17025, and to demonstrate traceability to national or international measurement standards. Organizations like www.npl.co.uk continue to play a central role in developing reference calibration methods and providing benchmark services that underpin the industry’s credibility and reliability.

Third, the integration of artificial intelligence (AI) and machine learning in gamma-ray imaging systems is creating a need for new calibration protocols. As imaging devices become more sophisticated, calibration services must adapt to support these next-generation technologies. Leading instrumentation manufacturers such as www.thermofisher.com are expected to collaborate closely with calibration specialists to ensure their systems maintain optimal accuracy and compliance in diverse field conditions.

Over the next several years, the industry roadmap will likely emphasize partnerships between calibration service providers, equipment manufacturers, and regulatory agencies to establish harmonized standards and best practices. Strategic opportunities exist for providers who can offer comprehensive, globally recognized calibration solutions, and for those who invest in workforce training and advanced analytical capabilities. As digital transformation accelerates, seamless integration of calibration data into asset management and regulatory reporting platforms will become a key differentiator, supporting operational efficiency and regulatory adherence.

Sources & References

- www.nist.gov

- www.npl.co.uk

- www.mirion.com

- www.sgs.com

- www.intertek.com

- www.iaea.org

- www.rapiscansystems.com

- www.leidos.com

- www.ge.com

- www.olympus-ims.com

- www.siemens-healthineers.com

- www.thermofisher.com

- www.tuv.com

- www.ptb.de

- www.oecd-nea.org

- www.canberra.com

- www.rapiscan.com

- www.ametekcalibration.com

- www.flukecal.com